S&OP : the essential planning tool

When I think about the S&OP process and its definition, one thought comes to mind: ” Before the present era, never had so many skilled and educated men directed their attention to research […], never had such considerable capital been deployed […], never had so many results of experiments and observations so accurately described all these detailed operations. This underpins the superiority of the current era […]. “(John St Clare, Code of Agriculture, 1818).

In the 21st century, connected and with immediate information, “not knowing” is considered intolerable. More than in other eras, we think we can master and control everything with certainty. Yet there is no such thing as absolute certainty, and it is uncertainty itself that offers the opportunity to act, to take risks measured against historical data, observations and experience.

At company level, constantly seeking to control risks in order to achieve the best possible balance between workloads (demand) and capacities (supply), forecasting is essential if we are to take control of our own situation in the face of competition. Statistical forecasting models of demand variability support this risk management approach and provide food for thought for company managers. These forecasts then feed the planning process. Planning is an essential stage in any action, and action is essential if we are not to be in a reactive situation.

What no organization wants is to have to react rather than act, as this makes business management more complex. The S&OP concept is an effective tool that has already proved its worth in terms of good planning, business management and serves company’s financial interests.

What is S&OP? Definition

S&OP stands for Sales and Operations Planning,it is a global tactical planning process for sales and operations with a medium- to long-term focus. which aims to balance loads and capacities. It is reviewed on a monthly basis and brings together all the company’s department managers (production, logistics, supply chain, sales, finance, etc.). The department responsibles in charge compare and validate together scenarios for a set of aggregated data (product families — maximum 20), for a defined timeframe (often 12 to 24 months) in a targeted geographical area, within the set budget. Ideally, it includes suppliers, subcontractors and customers, both upstream and downstream. The S&OP process supports the change management essential to its success, thanks in particular to the development of a common language and greater collaboration between departments.

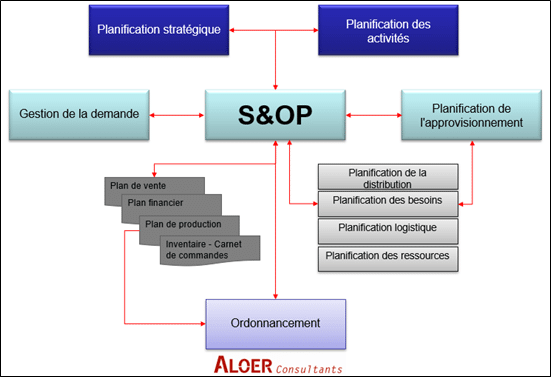

At the instigation of the executive management and the watchful eye of the finance department, S&OP requires all department managers to coordinate their efforts to find the right match between customer demand and available resources, between demand forecasts and operational capacities. The S&OP is the translation into of the vision into achievable and profitable action plans, objectives and strategic development projects set by the company’s management. Its centralized design is known, shared and then executed in a decentralized way in all departments. From S&OP will flow other, more operational plans (MPS, MRP, Scheduling) which will also be useful for business management.

What is the S&OP cycle?

S&OP is an iterative process, a cycle that must be repeated regularly. During the meeting, the scenarios planned the previous time are compared with the observed reality to assess their relevance. We also need to validate the planning for the coming period. It’s worth adding that, just as management is involved in starting up an S&OP process, it’s vital that they take part in the monthly reviews to arbitrate the decisions to be taken.

S&OP needs to be repeated several times to ensure that the decision-making players within the organization have a more homogeneous knowledge of the organization, and that forecasts and planning are more accurate. In other words, S&OP will bring increased foresight and discernment to predict future events. This planning process can’t cover every possible scenario, but it does provide flexibility and agility, just as it enables us to be armed in the face of uncertainty: the reed bends but doesn’t break.

Find out more about S&OP in the ALOER White Paper: S&OP in SMI/SMEs (in French)

Company resilience impacted by current events

What is the VUCA world?

The acronym VUCA stands for Volatile,Uncertain, Complex and Ambiguous. This 90s concept attempts to describe a world undergoing strong societal, economic, technological and environmental change. It’s true that these changes are taking place more rapidly and are amplifying. They are increasingly difficult to interpret and predict. Now more complex to analyze and understand, and sometimes, to top it all, contradictory.

Against this backdrop VUCA context, changing geopolitics, climatic incidents and many other unforeseen disruptions are having a major impact on value chains. Nevertheless, the company and its players still have to resolve the supply/demand equation. There’s definitely nothing very exciting on the agenda, in a situation of imbalance.

If demand exceeds supply, the company suffers :

- a drop in its service level,

- higher material costs due to shortages,

- irregular exceptional production and special transport,

- lower profit margins.

Conversely, when demand is lower than supply :

- stocks are increasing,

- the efficiency of the production apparatus falls,

- human resources become under-utilized.

S&OP in a VUCA world

To counter the imbalance between supply and demand, companies need to be resilient, agile and adaptable. Let’s transform the acronym VUCA into Vision,Understandable, Customer and Agility, one of its positive versions. We understand that the new meaning of this acronym is very similar to the objectives of S&OP.

S&OP to the rescue of cash?

As already mentioned, S&OP is designed to provide concrete support for the strategic vision defined by management. It helps you to better identify, understand and manage the issues facing your business sector. This vision brings clarity and thus renewed confidence for the company’s players, as they follow a guideline. It helps us to focus on our customers and serve them better. Repeated monthly S&OP review meetings enable: a better understanding of results, and therefore better adjustment of business management. However, S&OP will have to attempt to plan for complex scenarios that have hitherto received little or no consideration.

S&OP enables better overall management of the identification, arbitration and resolution of problems, always with a view to achieving the ambitious strategic objectives set by management and ensuring the company’s optimal operation. S&OP inevitably provides visibility, so that we can act with complete control in this VUCA environment. Mastering uncertainty becomes a weapon, a “deception maneuver” to become unpredictable and create doubt among competitors as to our intentions. It contributes to the company’s singularity: “I act, and my competitor reacts!

S&OP also benefits finance

As mentioned and explained in the definition, the finance department is essential to the S&OP process in order to compare and validate scenarios against different financial indicators.

Conversely, S&OP also serves finance. It plays a concrete role in improving logistics performance measurement indicators (OTIF, service costs, stock coverage, overall rate of return, capital employed). More specifically, it has a beneficial effect on the company’s Working Capital Requirement (WCR).

WCR performance has a systemic impact on cash flow, sales and margins, through the convergence of multiple coordinated decisions by the company’s various departments. Services which, precisely, organize themselves together during the S&OP process, projecting themselves through multiple, flexible scenarios in search of optimization of capital management (inventory, cash, credit), margins (speed of cash generation), customers (market share, sales, quality).

To make it easier to estimate overall costs and anticipate key business decisions, or at least the risks that the company might incur, each of the scenarios takes into account the three common accounting dimensions of WCR by simulating :

- valued inventories and production (raw materials, work-in-progress, finished goods),

- customers (sales volumes, receivables),

- suppliers (purchase quantities, debts),

- exchange rates, variations in material costs and upstream/downstream transport in the supply chain.

Contributing to a good ROI

Last but not least, S&OP serves finance more broadly by reducing the variability of return on investment (ROI). The relationship ∆ visibility -> ∆ variability -> ∆ return on investment, demonstrates that with better visibility, variability (between realized scenarios and reality) is reduced. S&OP provides this visibility, resulting in a controlled ROI for greater agility and competitiveness.

However, the objectives of supply chain and finance remain quite antagonistic when it comes to WCR. The supply chain doesn’t like to see it reduced, because of the risk of shortages of finished products or suppliers, for example, or a drop in operating margins. On the other hand, finance doesn’t like to see it increase, as it means an increase in the capital expenditure of financial resources, a reduction in investment capacity or an increase in the risk of stock obsolescence.

The WCR or cash flow gap, resulting from the company’s current activity, and the management of supply chain planning through S&OP are therefore closely linked. Arbitration by the company’s management will then be decisive in finding the right balance once again.

What are the benefits of S&OP?

S&OP, as an iterative process of global tactical planning of sales and operations, enables profitability targets to be reached thanks to decisions taken collegially by the heads of the company’s departments. It enables everyone to speak the same language at last, and encourages communication between departments and the integration of teams, i.e., greater cross-functionality and transparency. The clear-sightedness and discernment it brings enables to face up to a volatile, uncertain, complex and ambiguous environment with vision, understanding, customer focus and agility. It improves performance, visible through logistics indicators but also through WCR management. S&OP clearly helps to increase visibility by reducing variability, thus improving the management of the company’s business and its ROI. It enables you to manage your business effectively and “not let yourself be managed or submit to the markets”, and to convince your financial stakeholders and decision-makers.

” [Victorious generals adapt] plans to circumstances. Other armies try to adapt circumstances to their plans ” (George Patton, General Patton’s Secret Notebooks, 2011).

S&OP is therefore also the art of making decisions with imprecise or even false data. These data are biased, incomplete and often inaccurate, as they try to distinguish a distant, blurred future. Rationalizing this data with experience, feeling and intuition is essential to humbly achieve the best possible S&OP.

ALOER Consultants helps companies set up their S&OP process.

Article written by Fantin Richard

Fantin Richard developed his international experience in the automotive industry following a dual academic training in Supply Chain Management and International Business. Skilled in project management, supply chain assessment, change management, training and team management in multicultural and multilingual contexts and at various levels of the supply chain, he pays particular attention to the coherent and sustainable development of activities in their three dimensions: economic, social and environmental.

Press contact Christine Inglessi — +33 6 38 26 15 64 — Press contact contact@aloer.fr